Cultural Day at First Ally Capital: A Vibrant Celebration of Unity

First Ally Capital recently held its highly anticipated annual Cultural Day on September 27th 2024, a colourful and vibrant event that celebrated the rich diversity of Nigerian culture in both our Lagos and Abuja offices. This year’s festivities brought together employees from a variety of ethnic backgrounds, uniting them in a shared appreciation of their traditions, customs, and heritage.

The day commenced with employees proudly showcasing traditional attire from across Nigeria. The runway was ablaze with vivid colours and intricate patterns, as staff members confidently displayed their cultural pride. The excitement peaked with the announcement of the best-dressed male and female employees, whose stunning outfits embodied the spirit of the day.

One of the standout moments was the presence of the "BUBU ladies," affectionately referred to as "The Rich Aunty Vibes." These ladies brought an air of sophistication and glamour to the event, dressed in elegant bubu attire that truly captured the essence of Nigerian style.

Cultural performances took centre stage, with employees representing different ethnic groups through mesmerising dance and music routines. From the graceful South Western movements to the high-energy South East and South South performances and the beautiful diversity of the North and Middle Belt, the displays were met with cheers and applause, as the audience clapped along to the infectious rhythms.

Adding to the excitement, an impromptu drama presentation took place, designed to showcase the beauty and diversity of the Nigerian people and their culture. The on-the-spot performance enthralled the audience with its creativity and depth, reflecting the country’s rich storytelling traditions.

Addressing the staff, Olumayowa Ogunwemimo, the Group Executive Director praised the team for their hard work and outstanding performances. She emphasised the company’s commitment to fostering an inclusive and diverse workplace, where employees from all backgrounds feel represented and valued.

Cultural Day at First Ally Capital was a tremendous success, uniting employees in a celebration of their shared heritage. The event was a testament to the company’s dedication to promoting unity, diversity, and mutual understanding.

This year’s celebration not only highlighted the beauty of tradition but reinforced the core values of inclusivity, respect, and collaboration that define the culture at First Ally Capital.

IMPORTANT NOTICE- IMPERSONATION INCIDENCE

We have become aware of an impersonation incident involving one of our directors. At First Ally Capital Limited, we prioritise security and are actively investigating this matter.

Rest assured, our commitment to upholding the highest ethical standards remains unwavering. We have initiated a thorough investigation.

Should you have any concerns or suspect fraudulent activity, please reach out to us at info@first-ally.com. Your security is our utmost priority.

We greatly appreciate your understanding and continued trust in us.

Sincerely,

First Ally Capital Limited

FIRST ALLY ANNOUNCES APPOINTMENT OF GROUP EXECUTIVE DIRECTORS

First Ally Capital Limited, an investment banking Group headquartered in Lagos, is pleased to announce the appointment of Mrs. Olumayowa Ogunwemimo and Mr. Tolu Osinibi as Group Executive Directors, effective from September 2023.

Mrs. Olumayowa Ogunwemimo has been an integral part of First Ally Asset Management (FAAM), the asset management subsidiary of First Ally Capital, since her appointment as Managing Director in September 2020. Her exceptional leadership has significantly contributed to the growth and success of FAAM. As a Group Executive Director, Mrs. Ogunwemimo will continue to lead FAAM, while taking on additional responsibilities within the Group.

Mr. Tolu Osinibi joined First Ally Capital in September 2023, bringing with him a wealth of experience in the financial sector. Prior to joining First Ally, he served as the inaugural Managing Director/CEO of FSDH Capital Limited, the investment banking and stockbroking subsidiary of FSDH Holding Company Limited. His previous roles include Managing Director/CEO of FCMB Capital Markets Limited and a Director at KPMG Nigeria, where he was responsible for corporate finance advisory services. Mr. Osinibi brings a wealth of experience in financial advisory and execution capabilities to First Ally.

Commenting on these appointments, Mr. Olufemi Akinsanya, Chairman of First Ally Capital, expressed his delight, stating, "We are thrilled to welcome Tolu to the expanding First Ally team and to witness Olumayowa's transition from leading our rapidly growing asset management division to taking on broader Group responsibilities."

Further discussing the appointments, Mr. Ebenezer Olufowose, Group Managing Director/CEO of First Ally Capital, remarked, "Mayowa has been a valuable asset to our company. With Tolu joining our highly skilled and experienced management team, along with the reinforcement of our Group and subsidiary Boards, First Ally Capital is well-prepared to uphold its commitment to delivering outstanding services to its clients and to realizing new business prospects and opportunities."

First Ally Capital Advises Access Holdings Plc on M&A Transactions

First Ally Capital advises Access Holdings Plc (“Access Holdings”) on the acquisition of 80% equity interest in First Guarantee Pension Limited (“FGPL”), the indirect acquisition of Sigma Pensions Limited, and the subsequent merger of Sigma Pensions Limited and First Guarantee Pension Limited leading to the creation of Access Pensions Limited.

First Ally Capital is pleased to have advised Access Holdings on its majority acquisition of First Guarantee Pension Limited and the subsequent acquisition by First Guarantee Pension Limited and First Ally Asset Management Limited of all the issued shares of Actis Golf Nigeria Limited, the sole shareholder of Sigma Pensions Limited.

Following the completion of the two acquisitions and with the approvals of the National Pension Commission and the Federal Competition and Consumer Protection Commission, Access Holdings initiated the merger between Sigma Pensions and First Guarantee Pension Limited, which was subsequently sanctioned by the Federal High Court.

First Guarantee Pension Limited was dissolved without being wound up under the terms of the merger, and the enlarged Sigma Pensions was renamed Access Pensions Limited.

PERSONAL TRUST MICROFINANCE BANK OPENS A NEW HEAD OFFICE IN LAGOS

L-R: Dr Biodun Arokodare, Director, First Ally Capital; Mr Anthony Uponi, Director Personal Trust; Mr Anthony Owuye, Director, Personal Trust; Mr Ebenezer Olufowose, Group Manging Director, First Ally Capital; Major Gen Obi Umahi (Rtd), Special Guest; Dr Okey Nwuke Chairman, Personal Trust; Dr Ayoola Oduntan, Director, Personal Trust; Mr Edeki Bakare, Managing Director, Personal Trust and Mr Segun Omidele, Director, First Ally Asset Management at the recent opening of the head office of Personal Trust Microfinance Bank in Lagos.

Personal Trust Microfinance Bank, a subsidiary of First Ally Capital, recently opened its new head office building at 32, Ikorodu Road, Jibowu, Lagos. Prior to the opening, the bank operated from 67, Ogunlana Drive, which will continue to serve its clients located in Surulere and environs.

Personal Trust was incorporated in September 1993 as Personal Trust Savings and Loans Limited and operated as a primary mortgage bank until 2014 when it was acquired by First Ally Capital and converted to a state microfinance bank. It has four branches located in Jibowu, Surulere, Sandgrouse and Bariga. With significant new investment from First Ally Capital, Personal Trust has forayed into digital banking using strategic partnerships with FinTechs. It has invested in digital channels which enable its customers to transact business from the comfort of their homes, offices etc. The new office will not only give more people access to financial services but also draw the bank closer to its mission to serve and empower people, businesses and communities by creating wealth and enhancing lifestyles.

Speaking during the opening event, Dr Okey Nwuke, the Chairman of the board of Personal Trust said, “We are excited about the launch of our new head office. The new office provides a comfortable environment where we can change lives and impact people and businesses economically. We assure our customers that the exceptional customer satisfaction that has helped the company to thrive over the years, will be given increased impetus with the opening of our new office”.

The Group Managing Director of First Ally Capital, Mr Ebenezer Olufowose, in his remarks, noted that microfinance / digital banking is an important element of First Ally’s strategy. He noted that Personal Trust has been positioned as a digitally enabled microfinance bank adding that the Group will continue to support the bank to ensure that its capital base is robust at all times and that Personal Trust drives innovation in its chosen segment of the financial services industry.

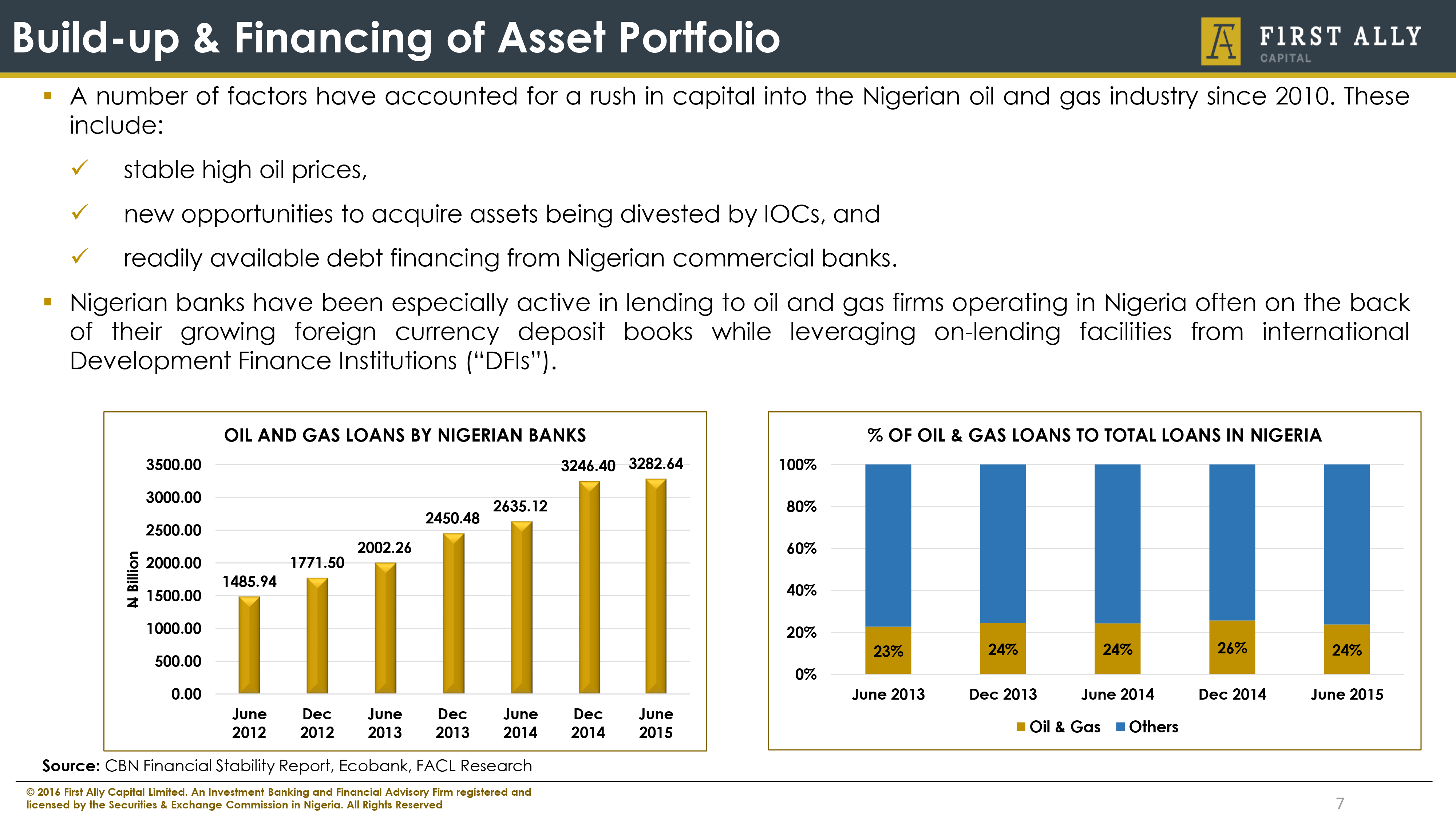

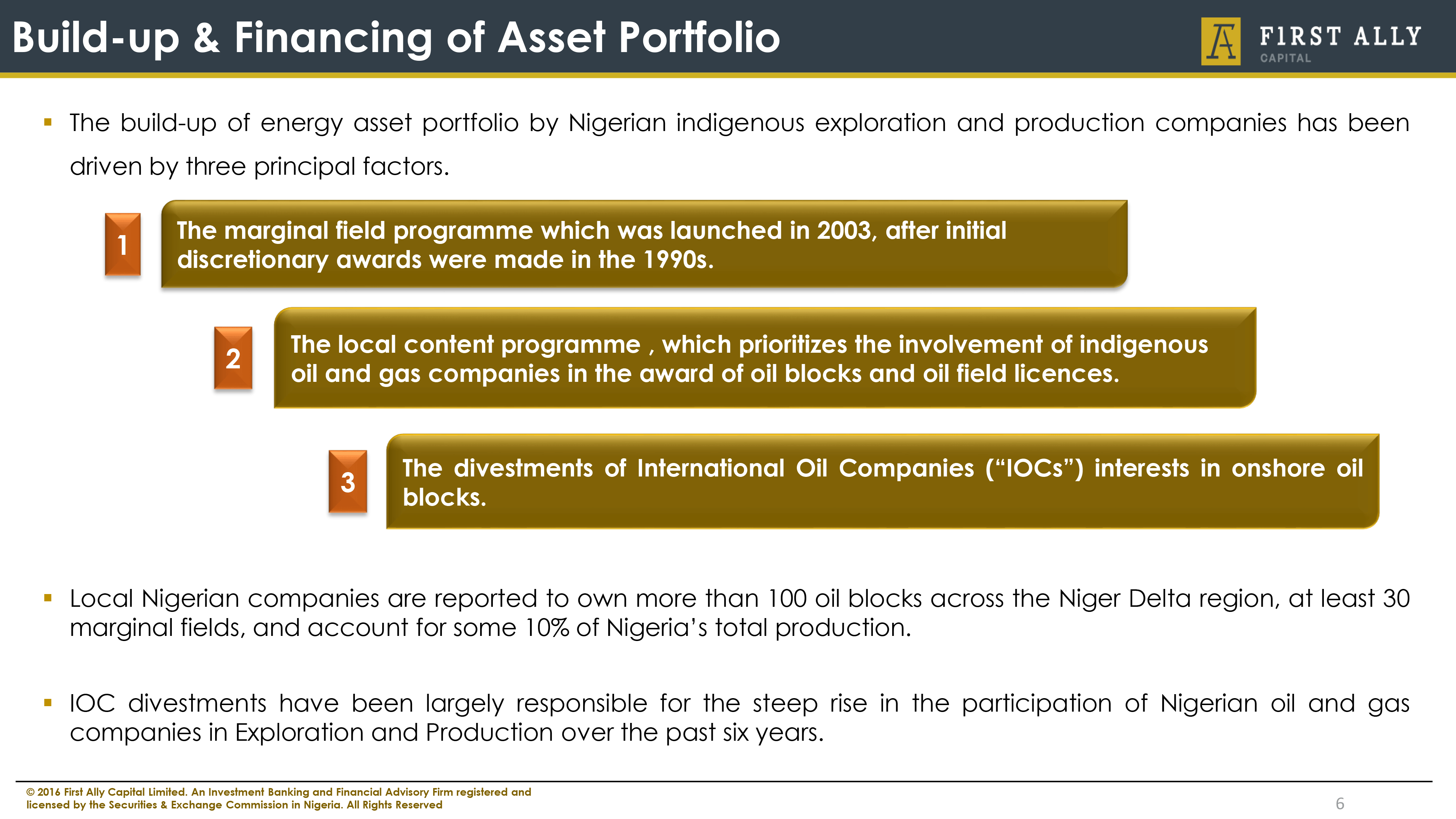

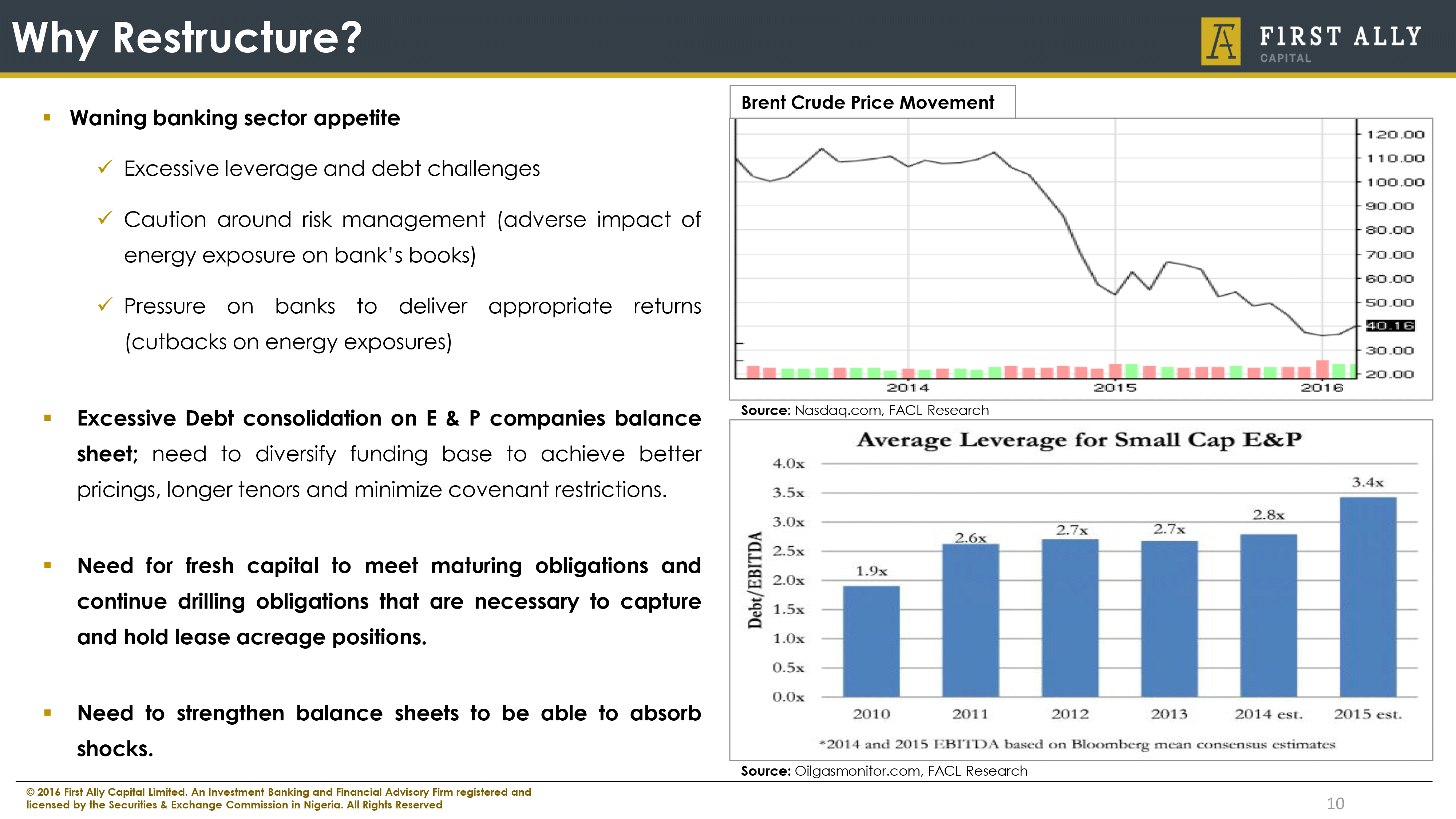

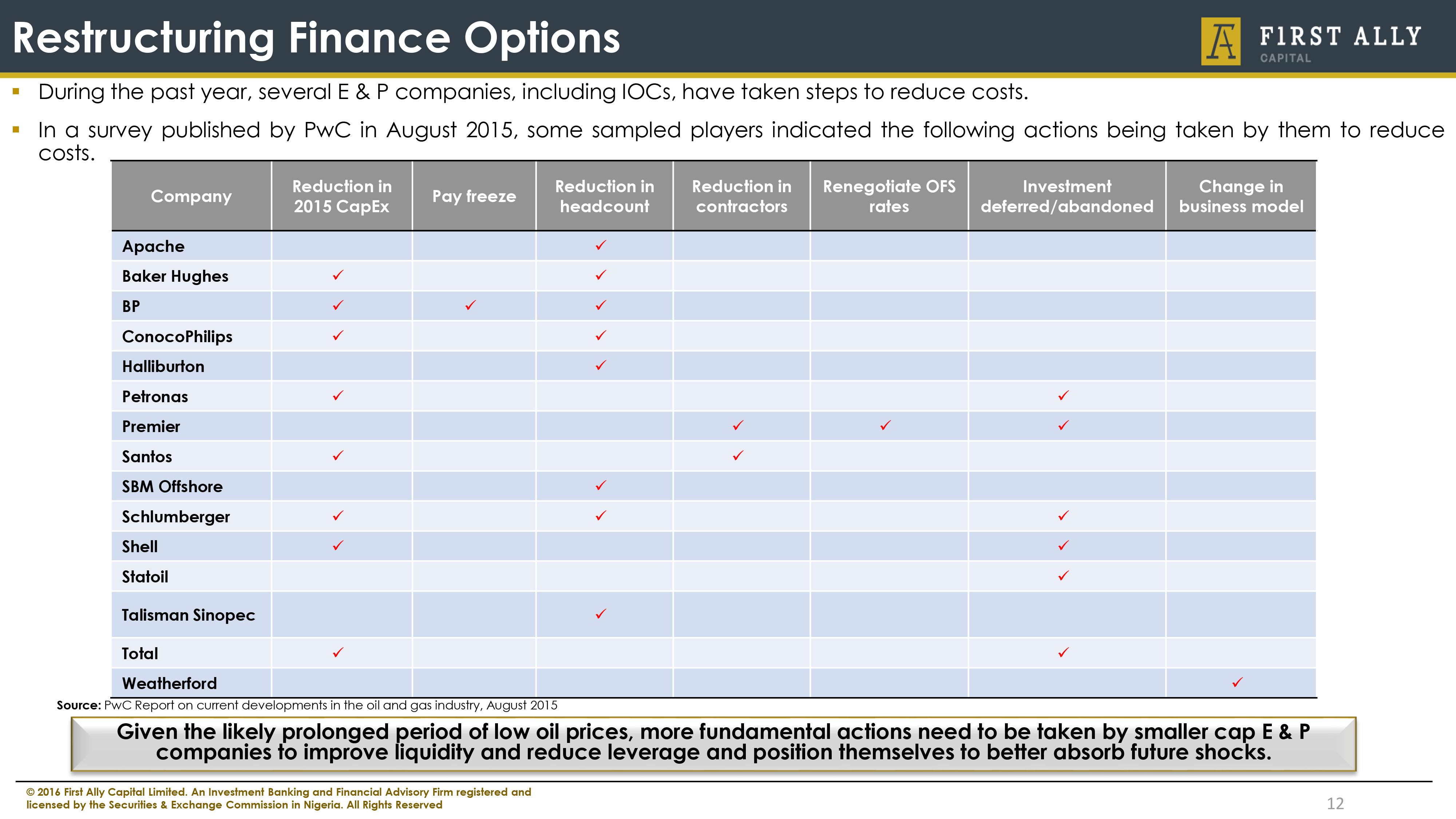

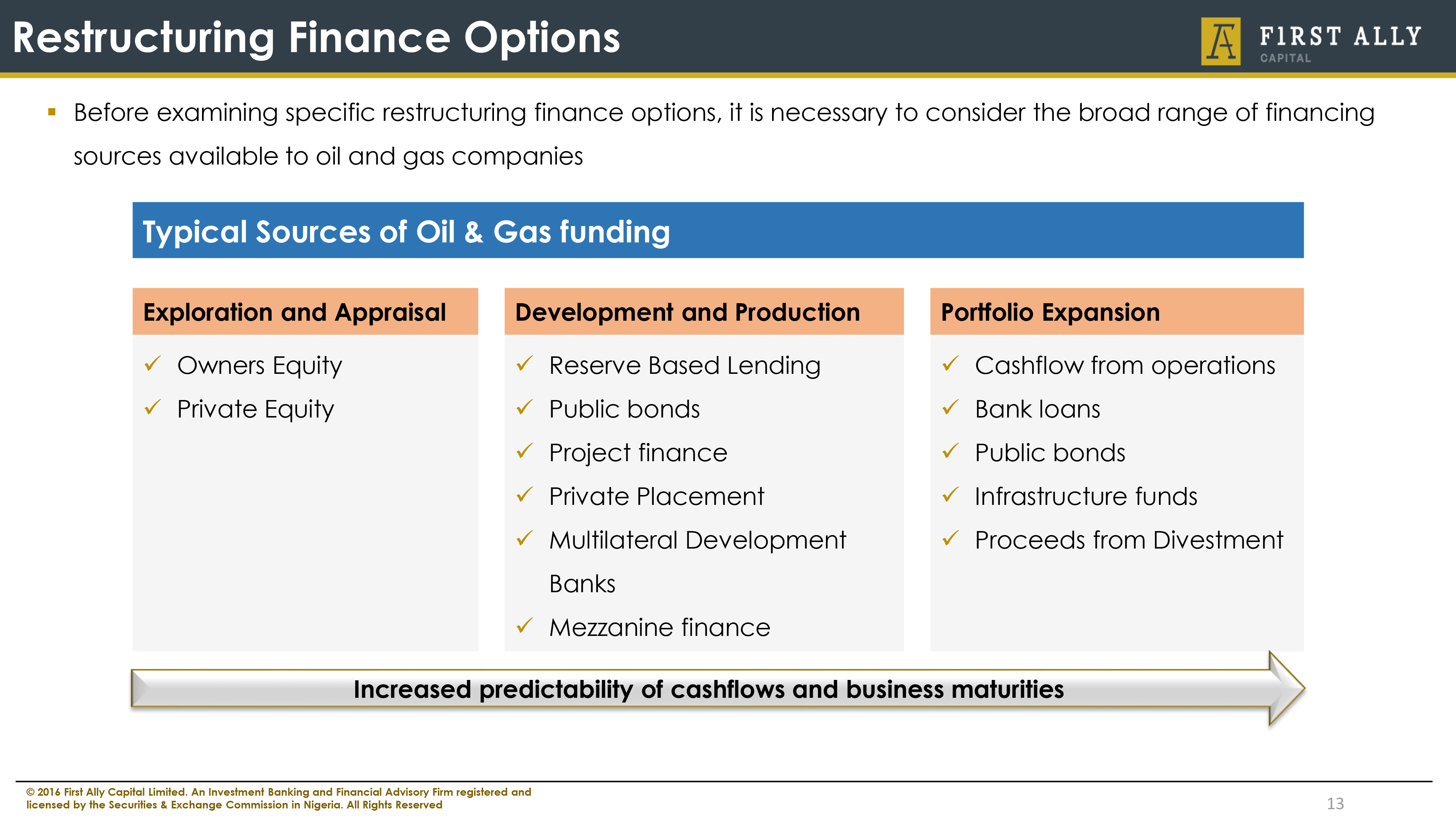

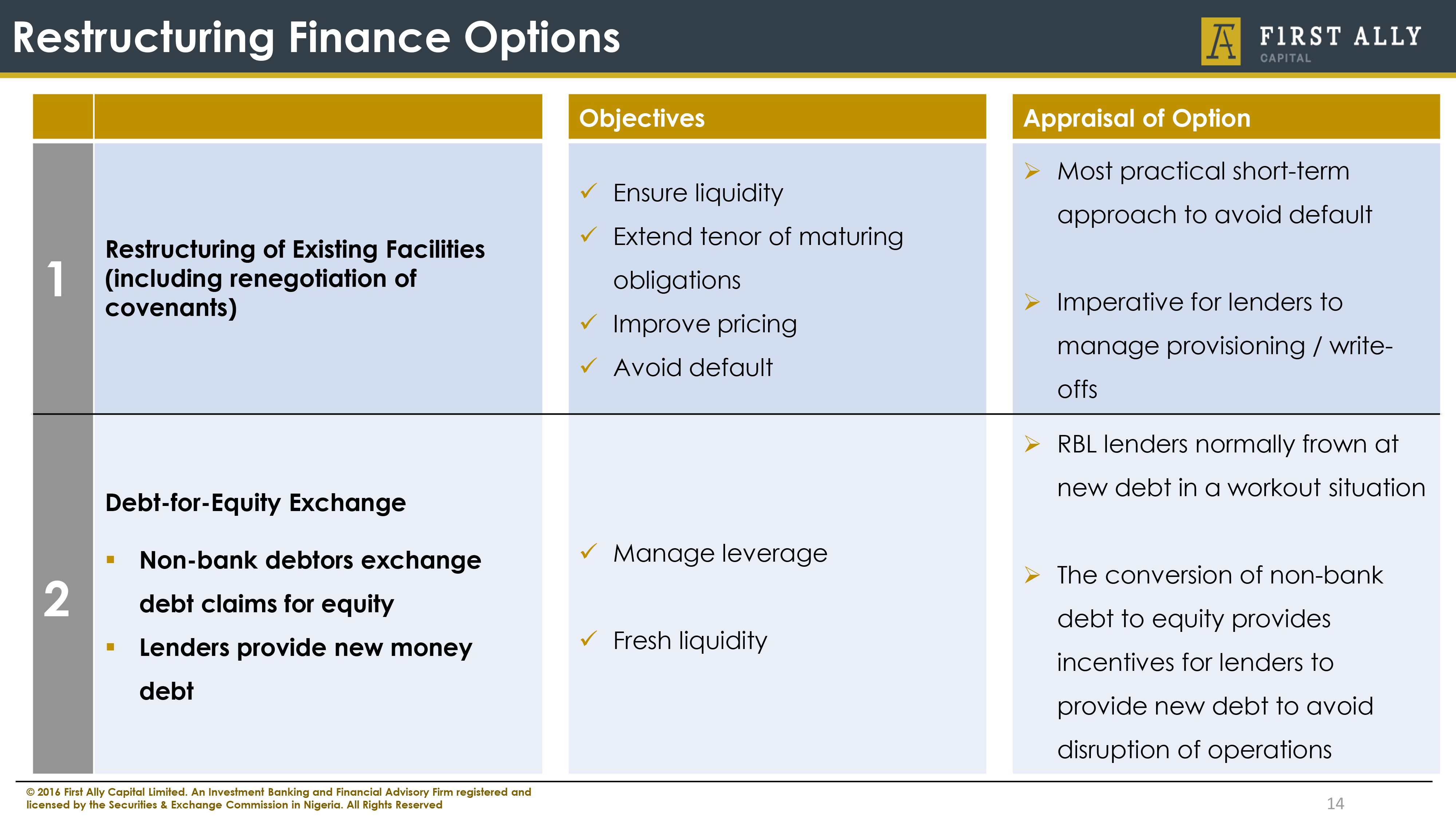

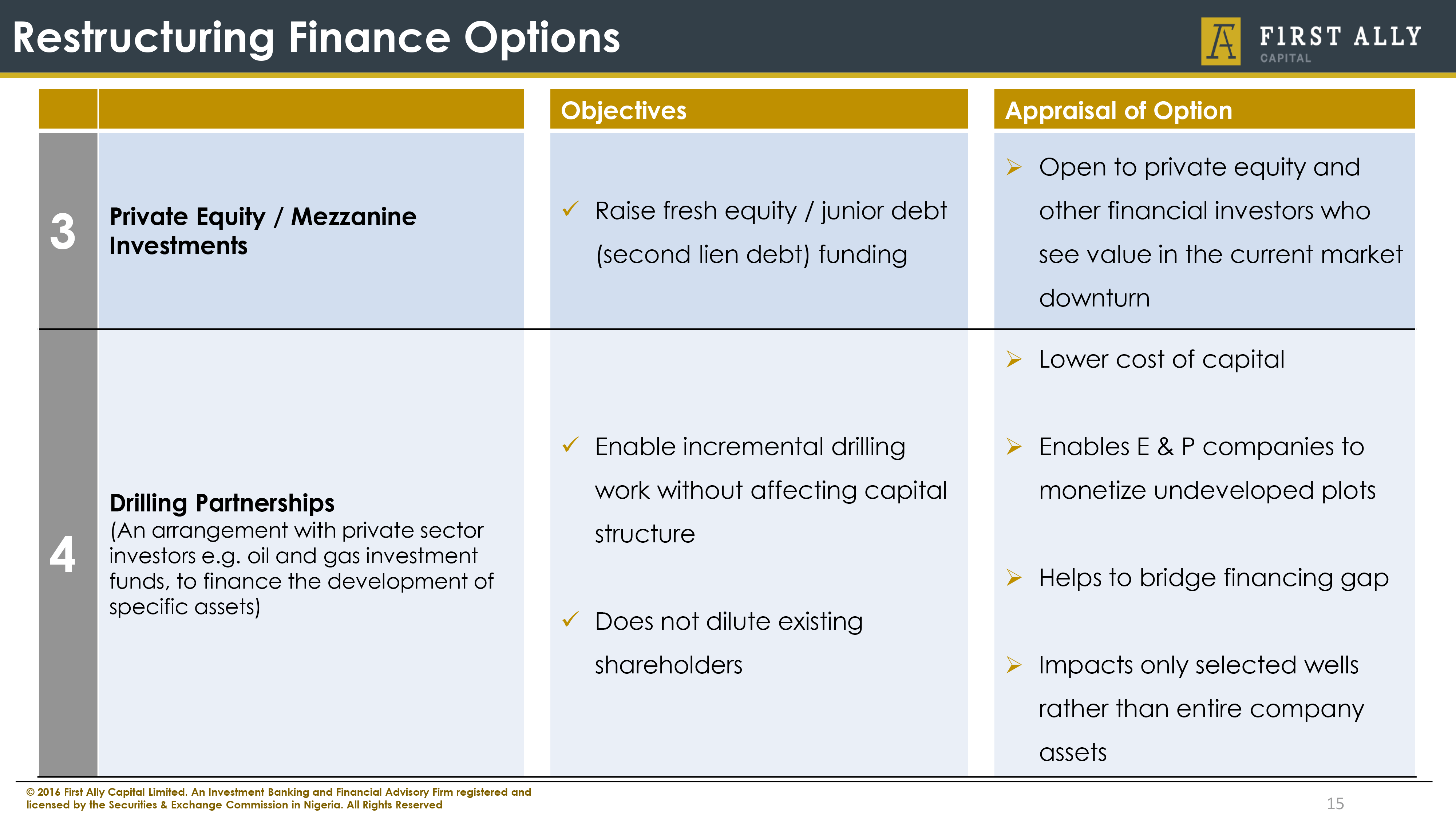

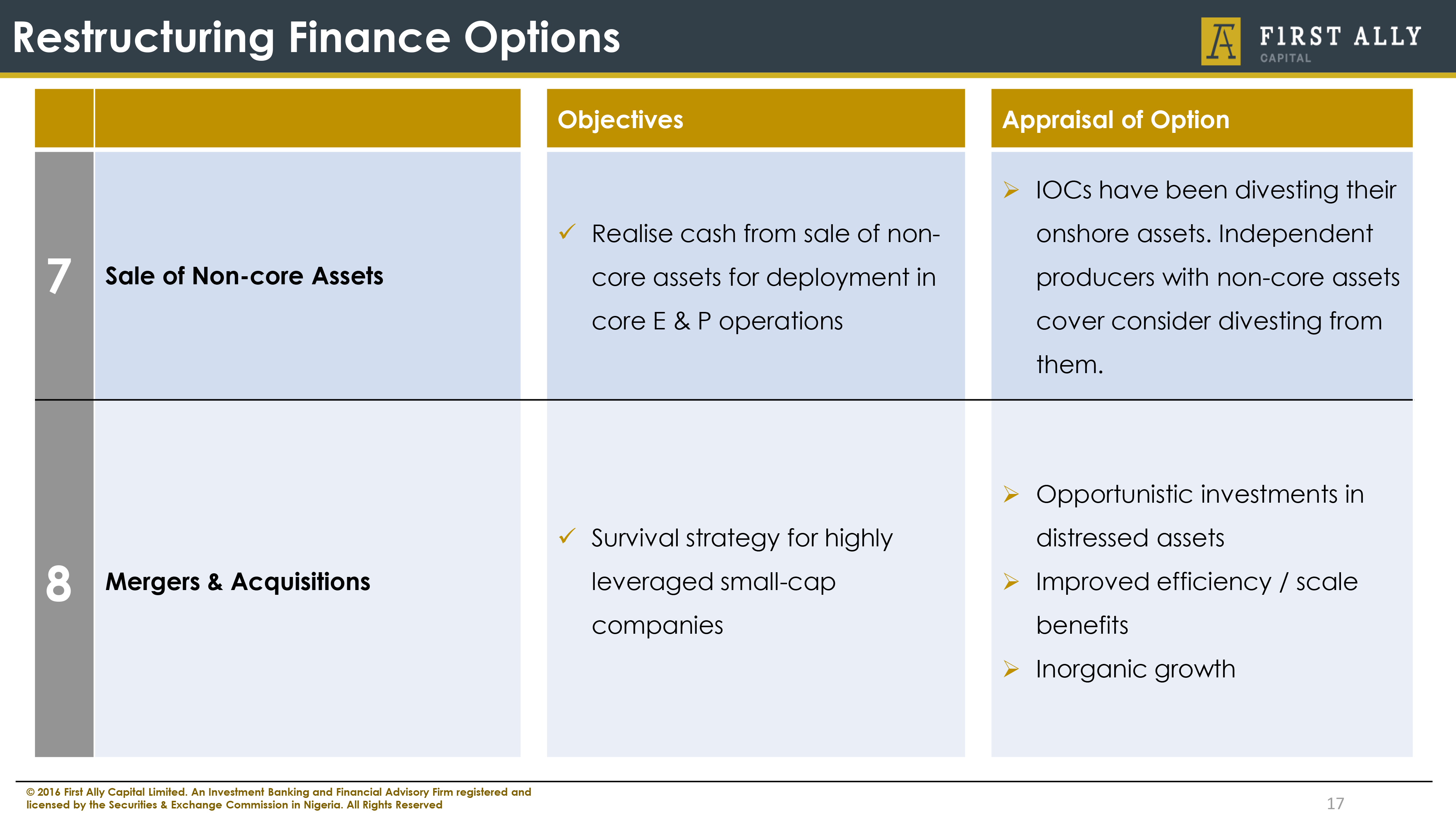

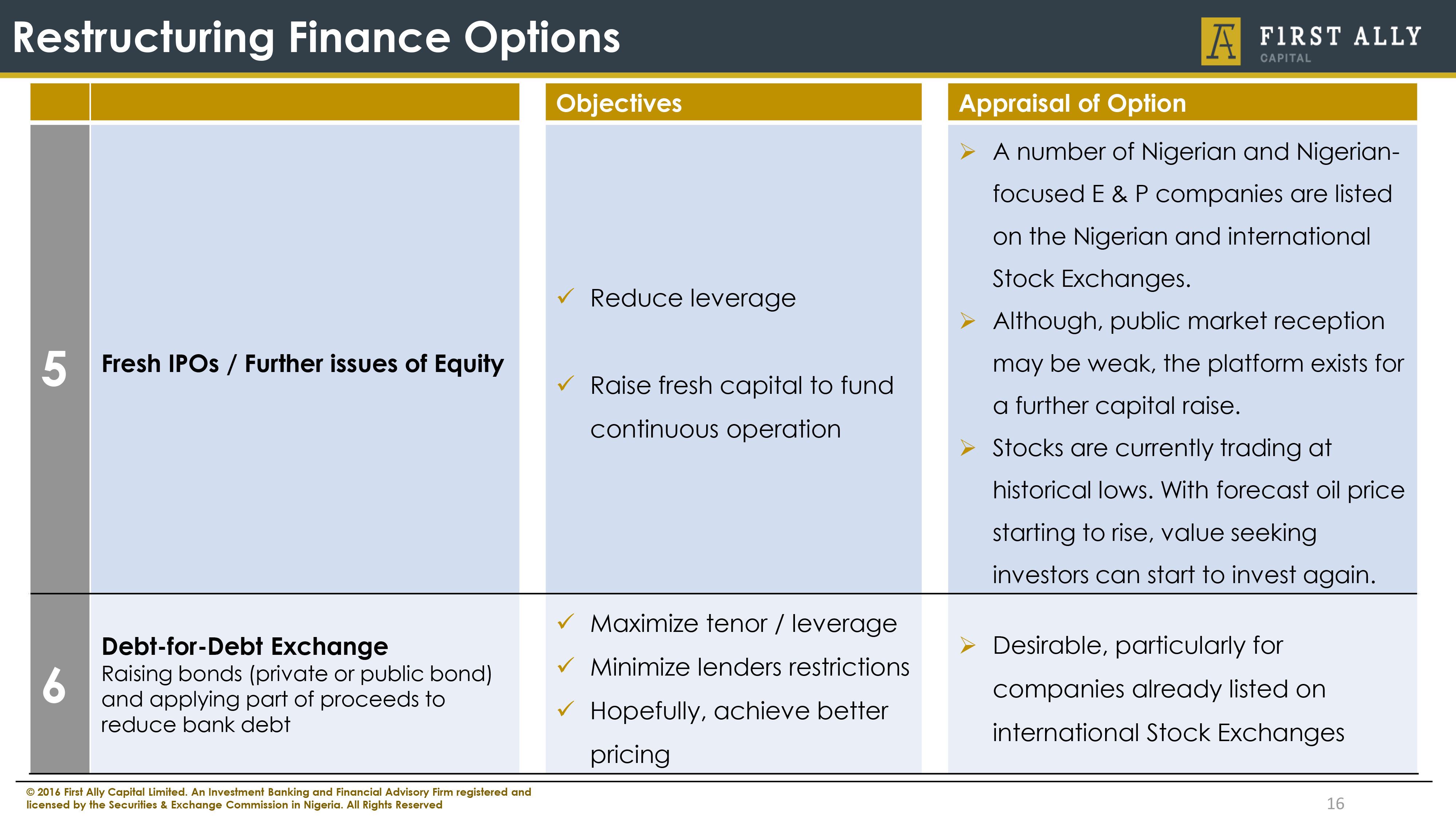

RESTRUCTURING FINANCE FOR ENERGY ASSET PORTFOLIO

A presentation on “Restructuring Finance for Energy Asset Portfolio” delivered by the Managing Director / CEO of First Ally Capital Limited, Ebenezer Olufowose, at the Energy Finance Forum 2016 of the Centre for Petroleum Information (Energy Finance Group). The forum was themed “Financing Nigeria’s energy projects amid uncertainty”. The presentation highlights the build-up & financing of asset portfolio in the Nigerian oil and gas sector, the compelling reasons to restructure and restructuring finance options available to indigenous E & P players.

FIRST ALLY ART CATALOGUE

First Ally Capital is proud to showcase the stunning modern and contemporary artworks loaned from the Femi Akinsanya Art Collection FAAC, at our new corporate headquarters.

These art pieces represent some of the best works of art from artistic pioneers as well as leading and emerging artists from Nigeria and the African Continent. Our Group is driven by excellence and integrity through commitment to ethical behaviour, innovation and quality. As such, not only do the art pieces beautify and transform our space, they also stimulate our drive for innovation and excellence; they whet our appetite for continuous improvements; they reinforce our commitment to making First Ally the best place for smart, inquisitive and ambitious people to thrive; and they resonate well with our core objectives of providing innovative financing solutions and enabling growth.

We trust that our clients and other stakeholders will appreciate these beautiful artworks as much as we do.

My thanks go to our Chairman, Mr Olufemi Akinsanya, for generously loaning us these exciting artworks from his Collections. We are hugely indebted to him for his wonderful support to the First Ally Group. My gratitude also goes to Mrs Sandra Mbanefo Obiago for the beautiful display of professionalism in curating this corporate art collection in our office.

It was a great delight working with her on this very important assignment.

Ebenezer Olufowose

Managing Director/CEO

First Ally Capital Limited

Our Blog

Kindly visit our blog here.